John Copps, Mutual Ventures – The future of social care and cooperative principles

- September 2023

At North West Mutual we know there is also a slices of the pie problem but we don’t want to be distracted by that. Whilst the cake sharing question is important another also needs answering. Why are there only three cakes here when some regions have more cakes, some of which were even baked here?

In the current system, the answer is straightforward. The strongest person gets all three cakes, another two are lucky if they get some crumbs and the fourth, well we don’t talk about them. Wanting to get and even getting all the cakes is seen as natural, good and fair. This the principle of having someone else’s cake and eating it or neoclassical economics. The current banking system is a cornerstone, the lifeblood of this approach.

We reject claims this is simply market forces or maximising cake holder value or that one person should get all the cakes, or even two of them. It doesn’t have to be this way and if it is this way then it’s because someone chose it. Perhaps a fairer outcome would be likely if each of those people had one vote.

However, cakes are tasty and markets are useful so let’s bank on different values where getting crumbs isn’t good enough, where the fourth person isn’t forgotten and where more of the cakes baked here stay here.

A fairer, trusted, local way of doing things needs a different sort of bank as it’s cornerstone, its lifeblood. A bank that shares its power and prosperity with its customers and is imbedded in its local economy. One where digital alone isn’t enough and where decision makers are spread across the region. One committed to prudently supporting both existing and new local bakeries.

To build such a modern, prudent, successful bricks, clicks and flicks bank with over £1billion of assets needs only a small percentage of local businesses and under 5% of the people in the North West to use it as their main bank. Then £1billion of local savings will be circulating through the bank back into the local economy creating local wealth, coming back into the bank to go round again and again. The maths are compelling. Another 5%, another billion.

We decided to test this by commissioning YouGov to run a survey in the North West among a representative sample of the population, not confined to potential fans or those predisposed to idea in the first place. The authoritative results exceeded our expectations. Some of the key findings were:-

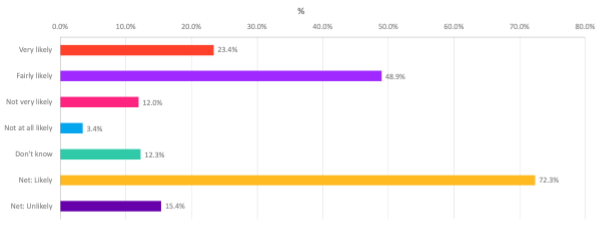

If a bank that provided the products and services you needed was committed to opening branches near you, how likely, if at all, would you be to consider it as your main bank?

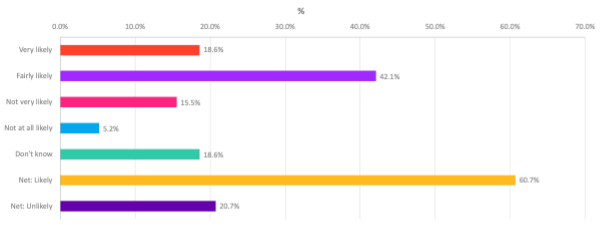

If a bank that provided the products and services you needed was owned by its local customers, how likely, if at all, would you be to consider it as your main bank?

We were confident before the survey that local people and businesses want something better than the existing monoculture banks. So confident that we’d already written our license application, built systems, designed branches and installed our digital banking platforms.

This independent, authoritative, representative survey clearly shows our modest target of a small part of the potential members in the North West signing up to create a billion pound, customer owned bank is realistic. If anything we’re being too cautious.

Encouraged by the clear, strong demand for a competent local bank that would be the cornerstone of a fairer, more sharing way of doing things, North West Mutual are determined to press on, raise investment and apply for a banking license because it will make such a real and lasting difference to the prospects of the North West.

Who knows, maybe if we can solve the cake problem the solution could be applied equally well to those pie issues.